top of page

All Posts

SIA or Permanent Establishment (PE) for Construction Projects in Latvia?

Foreign construction companies working in Latvia often ask: is it better to register a Latvian company (SIA) or operate through a permanent establishment (PE)? The correct choice depends mainly on project duration, reporting requirements, and transaction volume. VAT Registration for Construction in Latvia If you provide construction services in Latvia, VAT registration is mandatory in both cases: Construction services to a Latvian VAT-registered customer are usually invoiced

Kristaps Spruntulis

Dec 16, 20252 min read

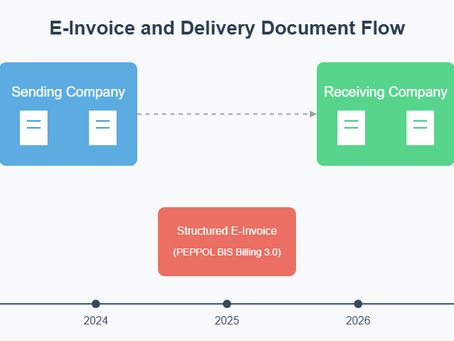

E-Invoices and Delivery Documents: What You Need to Know About the 2025 Changes

One of the most confusing aspects of the new e-invoicing requirements for accountants has been how these changes will affect delivery documents starting January 1, 2025. While structured e-invoice requirements don't directly apply to delivery documents, this doesn't mean you can skip creating a structured invoice when shipping goods. Understanding the Current Situation Many businesses currently use a combined document – a delivery note-invoice that merges multiple documents i

Kristaps Spruntulis

Dec 19, 20243 min read

Major Changes to Latvia's Personal Income Tax System Coming in 2025

On December 11, 2024, Latvia's parliament approved significant amendments to the Personal Income Tax (PIT) Law that will take effect from January 1, 2025. Here's what you need to know about these important changes. New Tax Rate Structure The current three-tier progressive tax system will be simplified to two main rates: 25.5% for annual income up to €105,300 33% for income exceeding €105,300 An additional 3% tax will apply to total annual income exceeding €200,000 Capital Gai

Kristaps Spruntulis

Dec 19, 20242 min read

Upcoming VAT Changes in 2025

In a significant move to harmonize VAT requirements for small and medium-sized enterprises (SMEs) across the European Union, Latvia is implementing new VAT registration rules starting January 1, 2025. These changes, stemming from Directive 2020/285, aim to create a more level playing field for businesses operating across the EU while maintaining support for smaller enterprises. Key Changes Coming in 2025 New Dual Threshold System The reform introduces a dual threshold system

Kristaps Spruntulis

Dec 19, 20242 min read

Important changes to board member "Presumed Income" threshold

Latvia's tax regulations include important provisions about "presumed income" (domājamais ienākums) for board members. Here's what business owners need to know for 2025. When Does Presumed Income Apply? Your company must handle presumed income taxation when two conditions are met: Your company has no employees or board members receiving at least the minimum monthly salary The company's monthly turnover exceeds threshold 5x the minimum monthly salary €3,700 (5x the minimum mon

Kristaps Spruntulis

Dec 19, 20242 min read

Streamlining Your Accounting with Automatic Bank Feeds

Streamlining Your Accounting with Automatic Bank Feeds Managing your business finances can be time-consuming, but it doesn’t have to be. At our accounting services firm, we’re committed to making this process more efficient and accurate for our clients. One way we're doing this is by offering automatic bank feeds —a powerful feature that automatically imports your bank transactions into your accounting software. This is a significant step toward helping businesses stay on top

Kristaps Spruntulis

Sep 25, 20242 min read

Mandatory Electronic Invoicing in Latvia from 2026: How We Help You Stay Ahead

Starting in 2026, Latvia will introduce mandatory electronic invoicing (e-invoicing) for businesses, aiming to streamline financial processes and enhance transparency. As an accounting firm, we understand that changes like these can feel overwhelming for businesses of all sizes. However, we’re here to ensure that this transition is not only smooth but also beneficial to your business. What Does the New E-Invoicing Mandate Mean for Your Business? Mandatory e-invoicing means th

Kristaps Spruntulis

Sep 23, 20243 min read

Business Trip vs. Work Travel compensation

When it comes to business travel, understanding the nuances of per diems and work travel regulations is crucial for both employers and employees. In Latvia, these distinctions are governed by Cabinet Regulation No. 969, which outlines the specific requirements and allowances for different types of travel. Let’s delve into the key differences between business trip per diems and work travel, including the taxation of per diems. Business Trips Definition and Scope: A business t

Kristaps Spruntulis

Aug 21, 20243 min read

Streamlining Document Submission for Accounting: A Guide for Confidentum Clients

Efficient document submission is crucial for smooth accounting operations. At Confidentum, we’ve implemented several methods to make this process as seamless as possible. Here’s a comprehensive guide on how to submit your invoices and documents effectively. 1. Dedicated Email for Document Submission For submitting invoices and documents, use our dedicated email. This email is automated and documents sent here are automatically uploaded to our accounting system. 2. Project Man

Kristaps Spruntulis

Aug 11, 20241 min read

Accounting Integration for Industry-Specific Solutions

In today’s fast-paced business environment, efficiency and accuracy are paramount. One of our standout offerings is our proprietary accounting system, designed to integrate seamlessly with your existing industry solutions. Whether your data resides in Excel, CSV, MySQL, other databases, or is accessible through API connections, we have the expertise to import this data directly into our system. For instance, if you use project management software to manage sales and supplier

Kristaps Spruntulis

Aug 11, 20242 min read

When to Start a Company: A Guide for Small Businesses

Starting a business is an exciting journey, filled with opportunities and challenges. For many small businesses and freelancers, navigating the decision of whether to start a company or use invoicing services can be daunting. At our accounting firm, we often encounter individuals with minimal invoicing needs who are hesitant to incur the costs and complexities associated with establishing a company. If you find yourself in a similar position, this guide is for you. When to

Kristaps Spruntulis

May 21, 20242 min read

Related Party Deals Under €250,000: What You Need to Know

If you're handling intercompany transactions and the value doesn't exceed €250,000, you might be wondering what kind of documentation you need to prepare. The good news is that you are not required to prepare a full transfer pricing local file or master file. However, you still need to justify your pricing to the tax office in a clear and understandable way. Here’s a breakdown of what you need to do: Essential Documentation Requirements 1. Deal Description and Functional Anal

Kristaps Spruntulis

May 21, 20242 min read

Exploring Latvia's Business-Friendly Tax System

In the world of global business, navigating tax systems can often be complex and daunting. However, Latvia has emerged as a standout destination for entrepreneurs and corporations alike due to its streamlined and advantageous tax environment. From its attractive corporate tax rate to its efficient administrative processes, Latvia offers a compelling case for businesses looking to thrive in a conducive fiscal landscape. Why Latvia is Ideal for Business? Latvia offers exception

Kristaps Spruntulis

May 21, 20243 min read

The Critical Role of Quality Control in Accounting Services

The importance of quality control in accounting services cannot be overstated. The integrity and accuracy of accounting practices are paramount. In this blog post, we'll explore how the principles of quality control, responsibility, and choosing reliable partners apply to accounting services and why they are crucial for building strong financial foundations. Quality Control: Ensuring Accuracy Every Step of the Way Just as in construction, where errors can lead to structural i

Kristaps Spruntulis

Mar 22, 20242 min read

Annual Accounts Preparation: A Comprehensive Guide for Businesses in Latvia

For businesses operating in Latvia, compliance with financial regulations is paramount. Annual accounts preparation is a cornerstone of this process, offering a snapshot of a company's financial health while fulfilling legal obligations. In this comprehensive guide, we delve into the nuances of annual accounts preparation in Latvia, elucidating key requirements, processes, and benefits for businesses. Understanding Annual Accounts Preparation in Latvia: Annual accounts prepar

Kristaps Spruntulis

Mar 21, 20242 min read

Spring Clean Your Business Finances: A Guide for Success

As the flowers bloom and the days grow longer, it's not just our homes that could use a little sprucing up – it's also an ideal time to give your business finances a thorough spring cleaning. Just like decluttering your living space can bring a sense of renewal, tidying up your financial records and practices can pave the way for a more organised, efficient, and profitable year ahead. At Confidentum we understand the importance of maintaining pristine financial health for bus

Kristaps Spruntulis

Mar 21, 20243 min read

bottom of page